Transaction Trends provides private equity sponsors and investors with middle-market transaction information and insights compiled by the BMO Sponsor Finance group — information that helps sponsors and investors better understand the current financing climate in the middle market.

15 years of BMO Sponsor Finance

2025 marks the 15th anniversary of BMO Sponsor Finance. Since our inception, we have had a singular mindset of being a trusted partner to our clients and providing leading capital solutions to the private equity community. Our growth at BMO has expanded to include not only capital solutions but now a full suite of offerings for funds, general partners, and private equity owned businesses.

In this edition of Transaction Trends, we reflect on our journey, highlight key milestones, and look ahead to the future.

Noteworthy growth and impact

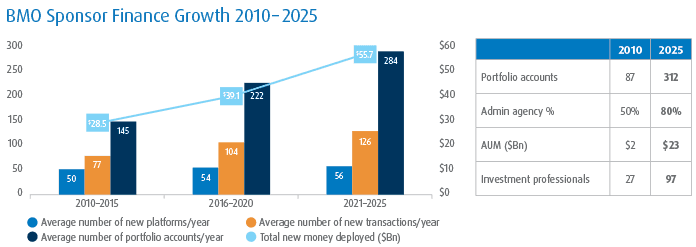

Over the past decade and a half, our team has delivered remarkable results:

Platform assets. Built a leading middle market franchise that has invested $49+ billion capital since inception, with growth from under $2 billion at inception to $23 billion today.

Client base. Partnered with nearly 350 middle-market private equity sponsors.

Portfolio. Closed 1500+ transactions with $131+ billion arranged since inception driven by strong and differentiated sourcing. Highly diversified portfolio of 312 borrowers today, with exposure across 40 sub-sectors within five core sector verticals — Industrials, Healthcare, Food & Consumer, Software, Technology & Professional Services, and Outsourced Services & Distribution.

Team. Senior management team that has worked together for 20+ years, supported by a team that has grown from 30 investment members to nearly 100, including expansion of a leading asset management platform.

Long-term relationships, proven results

Our success is rooted in enduring partnerships with our sponsor clients and portfolio companies. We have closed multiple platforms with nearly 230 sponsors and financed over 800 portfolio companies. We focus on being true partners and advisors, and not solely a capital provider, which we view as a differentiator in the growing private credit landscape. Demonstrating our growing trust and long-standing relationships with our clients, our Administrative Agency rate has increased from 50% to 80%, underscoring our leadership in the middle market.

Supporting growth across the spectrum

A key driver of growing customer relationships has been our ability to provide holistic solutions for a broad range of clients. We have financed companies with less than $10 million EBITDA to over $100 million EBITDA, across a variety of different industries. We have accomplished this by expanding our capital base — utilizing not only via BMO’s balance sheet but also adapting to the evolution of the direct lending market through the formation of CLOs, separately managed accounts, and co-mingled funds. This has allowed us to support continued growth and scale alongside our clients over time.

Leveraging the power of BMO

Over the years, the success of Sponsor Finance has driven a commitment by BMO to the middle market private equity community. As part of BMO Financial Group, we offer access to a full suite of services across Commercial Banking and Capital Markets, serving as a one-stop shop for our clients. As a long-standing global institution founded in 1817, BMO is the 8th largest bank in North America, with $1.3 trillion in total assets.

Growing alongside Sponsor Finance, BMO has committed significant resources to better serve our clients:

Sponsor Fund Lending and Wealth Management. Manage 200 active fund line facilities across 90 financial sponsors, as well as $4.5 billion of GP loan programs.

Leveraged finance. $153.0 billion in syndicated loan volume for sponsor-backed transactions over the last 5 years.

Investment banking/advisory. Full M&A and sector coverage teams supporting buy-side and sell-side activity across multiple industries.

Banking services. Cash management and treasury solutions, including interest rate and FX hedging services.

Driven by people and culture

We recognize that none of this success would have been possible without our greatest asset — our team. With deep expertise across five sector verticals, a senior team averaging over 20 years of experience and over 10 years tenure at BMO, our culture of collaboration and continuity continues to drive our success. As we look to the future, we remain committed to delivering value, building lasting partnerships, and supporting our clients’ growth across all different types of markets.

We’re the experts — Private Equity General Partner Loan Program

For nearly two decades, BMO Wealth Management has supported General Partners (GPs) with tailored lending solutions. In 2021, BMO formalized this expertise by launching the Private Equity Credit team in response to a growing market need for a tailored, dedicated solution. Today, BMO serves over 100 firms and 1,300+ professionals with these products.

The General Partner Loan Program (GPLP) offers a flexible solution for private equity firms to help employees finance their fund commitments. Loans are made directly to employees and secured by their interest in the fund, enabling employees to finance 50% or more of their capital commitments. Loans are interest-only during the drawdown period and principal is repaid upon a return of capital or realized gain in the portfolio — with no scheduled amortization.

For senior professionals, BMO can offer customized lending solutions that consider multiple fund interests, personal assets, and other income streams for enhanced leverage. BMO can also offer unique structures to address common issues for private equity employees including financing for junior professionals, lending to non-U.S. employees and loans secured by continuation vehicle interests.

Benefits of GPLP

Enhanced personal liquidity and the ability to leverage returns.

Supports larger fund commitments, aligning incentives with LPs.

Potential tax deductibility of interest expense.

Allows a portion of distributions to flow to individual borrowers.

Allows junior employees to participate directly in the fund.

Case study

Sponsor profile and situation overview

A $6 billion middle-market buyout firm raising its fourth flagship fund and a newer, smaller growth fund.

Challenges/goals

Senior partners wanted to encourage employees to invest in the fund. This had not been previously available as younger employees did not have access to the necessary cash to meet desired commitments.

Partners had historically comprised a significant portion of the GP commitment and needed a greater level of financing to maintain this commitment amid a growing fund.

Integrated BMO solution

BMO brought its Private Equity Credit, Wealth Management and Sponsor Fund Lending teams together to design a customized structure to address the needs of the client. A bifurcated loan structure was created to differentiate financing levels between Partners and non-Partners. BMO was also able to provide custom loans to founders based upon their personal balance sheets, including personal investments and deposits moved to BMO.

BMO spotlight

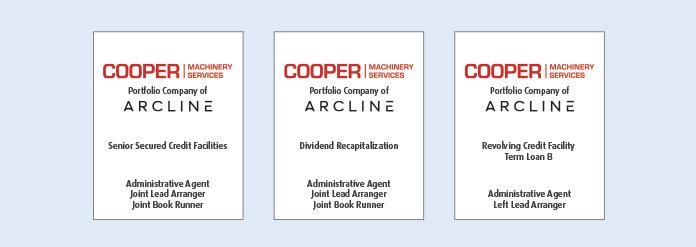

BMO brings multi-disciplinary expertise to deliver for Cooper Machinery.

Seamless full-lifecycle financing solutions — from the middle market to broadly syndicated loan market.

Tightest de novo issuance in market history.

The market for broadly syndicated loans is strong and BMO has the expertise and experience to help you access it.

BMO Capital Markets and BMO Sponsor Finance partnered to deliver a comprehensive refinancing and dividend recapitalization for Cooper Machinery Services (“Cooper”), a portfolio company of Arcline Investment Management. The transaction was the tightest spread for a B2 first time issuer ever. Proceeds were used to refinance existing debt and fund a dividend to investors.

Cooper Machinery is a leading provider of aftermarket parts, services, and emissions reduction solutions to the natural gas transmission industry.

Seamless execution in a dynamic market

Due to significant investor demand, the transaction cleared the market at S+325 and 99.75 OID. The transaction was ~2.8x oversubscribed with ~$2b in total investor demand. The majority of allocations were completed during pre-marketing, highlighting the value of BMO’s strong investor relationships.

This result is notable given the uncertain economic backdrop. By capitalizing on a window of favorable market conditions and executing a disciplined syndication process, BMO delivered a financing outcome that exceeded expectations.

Integrated approach: BMO Sponsor Finance + BMO Capital Markets

A critical factor in the success of the deal was the collaboration between BMO Sponsor Finance, which had a long-standing relationship with Cooper, and BMO Capital Markets, which brought the transaction to the syndicated market.

For Cooper and Arcline, this collaboration meant seamless coverage across the company’s entire lifecycle — from a middle market private credit solution to a broadly syndicated financing. This transaction demonstrates BMO’s ability to pair deep sponsor relationships with capital markets execution in order to deliver value for Sponsors and portfolio companies.

Broader implications

The Cooper case illustrates the importance of working with financing partners who can navigate across both private and syndicated markets, adjust to dynamic market conditions, and deliver collaborative outcomes to exceed client expectations.

A peek behind the curtain

A snapshot of BMO’s proprietary portfolio and transaction data.

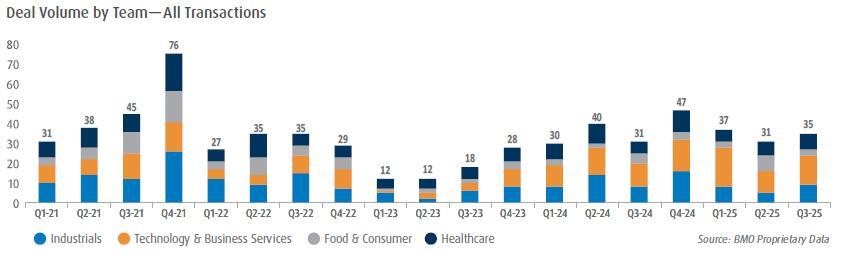

Quarterly transaction activity — all transactions

Deal activity in Q2’25 marked a notable slowdown, driving 1H’25 volumes to finish ~7% below 1H’24, despite a stronger start to the year. Q1’25 outpaced Q1’24, but Q2’s pullback — driven largely by tariff and policy uncertainty — more than offset early gains. Many sponsors paused on new platform investments and delayed decision-making, reflecting ongoing valuation gaps and a generally cautious sentiment.

Q3’25, however, marked a clear inflection point. Overall activity increased noticeably, particularly in new LBOs, both relative to the prior quarter and the prior year. As a result, new deal activity swung from being down in 1H’25 to up 24% YTD through Q3’25, signaling renewed momentum across the market.

Sector-wise, technology and business services remain the most active for new platforms, while industrials and consumer-facing sectors have been more muted amid tariff and demand uncertainty. Healthcare, while largely insulated from tariff-related pressures, saw deal activity decline in 1H’25 over the prior year as sponsors adopt a wait-and-see approach amid other headwinds such as Medicaid-related uncertainty (budget cuts, enrollment changes) and regulatory shifts tied to administration changes.

Looking ahead, there is growing confidence that the recent pickup in momentum will carry through year-end, even as the market adapts to a backdrop of ongoing policy and tariff uncertainty. Sponsors remain under pressure to exit longer-held investments and deploy capital into new platforms, factors that should continue to support deal flow in the quarters ahead.

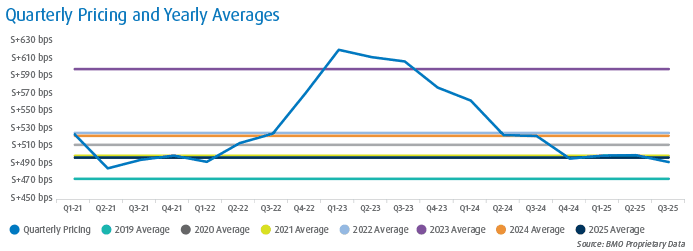

Pricing trends — all transactions

New transactions continue to clear predominantly in the S+ 450- 500 bps range. Competitive pressure remains most acute for higher quality credits, where the market is pricing new loans inside S+500. Up-front economics have tightened, reflective of the broadly syndicated market, underscoring borrower friendly dynamics.

Abundant dry powder across direct lenders in a muted M&A environment continues to compress economics.

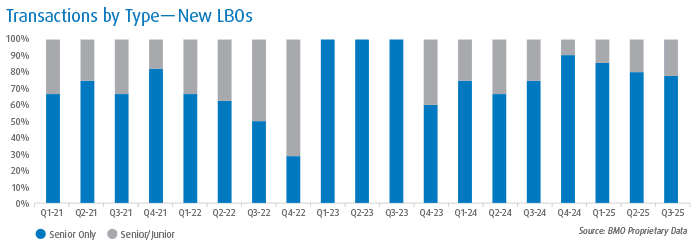

Capital structure type — new LBOs

Sponsor preference for single-tranche structures remains strong, driven by execution speed and simplicity. Competitive pressure among direct lenders has reinforced this trend, particularly for core middle-market deals.

Senior/junior structures remain limited and generally reserved for more complex situations; in a handful of cases, we’ve seen Sponsors layer a junior all PIK tranche to preserve cash flows and partially offset larger equity checks required in today’s market — still the exception, not the norm.

With ample dry powder, lenders are well-positioned to provide attractive funding solutions for borrowers seeking flexible financing options, further reinforcing their role as the go-to capital source in the current environment. Appetite for delayed draw term loans remains healthy — particularly for buy and builds — allowing lenders to support M&A roads maps while enhancing relationship economics.

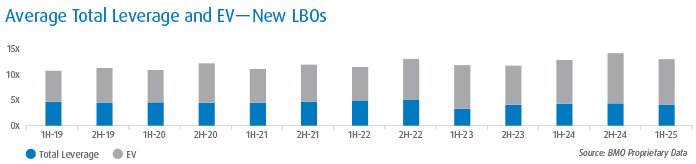

Average total leverage trends — new LBOs

Leverage levels have remained relatively stable quarter-over-quarter, holding just below recent highs. Lenders are leaning in selectively for high-quality credits, supported by strong equity cushions and improving cash flow coverage as base rates stabilize. However, leverage remains well below 2021 peak levels, constrained by a structurally higher cost of capital and a combination of lender discipline and elevated purchase price expectations, which together are driving equity contributions that often exceed 50% in all-senior structures.

While spreads have compressed and competition remains intense, lenders continue to prioritize resilience — placing strong emphasis on cash flow coverage, margin stability, and sector durability as core pillars of underwriting discipline.