Each year, I have the privilege of serving as the school director for the Wisconsin Bankers Association’s Agricultural Lending School. One of the most rewarding parts of that role is watching young ag lenders experience their “aha” moments, especially when they dive into financial ratios with my co-instructor, Dr. Kevin Bernhardt. One session that consistently stands out is our deep dive into the DuPont system of financial analysis.

Why? Because it flips the script. Instead of starting from the details and working up to the big numbers, the DuPont starts at the top—breaking down return on equity (ROE) into three key drivers:

Net profit margin

Asset turnover

Equity multiplier or leverage ratio

And it’s that middle one—asset turnover—that often gets overlooked by farm managers.

What is asset turnover?

Simply put, asset turnover (ATO) is a measure of how efficiently a company uses its assets to generate revenue. Bankers look at this to understand how well a company is converting its investments in assets into sales.

If you’ve got a lot invested in equipment, property or inventory, this ratio tells you how much revenue those assets are actually bringing in. High turnover? Great. Your assets are pulling their weight. Low turnover? Time to dig into why they’re not producing.

Here’s the formula:

Asset Turnover Ratio = Net Sales / Average Total Assets

So, if a company has $10 million in sales and $5 million in average assets, that’s a ratio of 2.0. That means for every dollar of assets, the company is generating $2 in sales.

Why it matters to dairy producers

Dairy operations are asset heavy. Land, equipment, facilities, livestock—all of it adds up. If those assets aren’t working hard to generate revenue, your ROE suffers, even if your margins are solid. ATO is listed under profitability ratios by the Farm Financial Standards Council (FFSC) for a reason. It’s not just about making money; it’s about making money efficiently.

Case study: DuPont in action

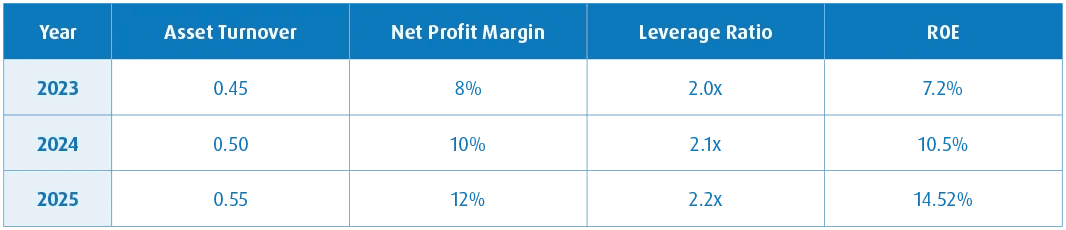

Let’s look at a hypothetical dairy operation over three years. We’ll track net profit margin, asset turnover and equity multiplier, then calculate ROE using the DuPont formula.

Notice how modest improvements in ATO and margin, combined with smart leverage, dramatically improve ROE.

How to improve asset turnover

If your ATO is lagging, here are some strategies to consider:

Sell or lease underutilized assets. Those assets are only working part time and not generating enough revenue.

Improve herd productivity and milk yield. Revenue matters.

Streamline inventory and feed management. While it pays to keep extra inventory to manage risk, carrying too much reduces efficiency.

Enhance marketing and sales channels. Look for other ways to grow revenue or add value.

Smart leverage: a word of caution

Leverage (via the equity multiplier) can boost ROE, but only if your assets are working efficiently. Overleveraging without strong ATO and net margins can backfire. Use debt strategically to acquire assets that generate revenue, not just sit idle.

ATO may not be the flashiest ratio, but it’s one of the most telling. It’s a window into how well your operation is using its resources. And when paired with the DuPont system, it becomes a powerful tool for diagnosing financial health and guiding smart decisions.

Bottom line: it’s not just about having assets; it’s about how well you use them. That’s what separates good businesses from great ones!

This article originally appeared in Progressive Dairy.