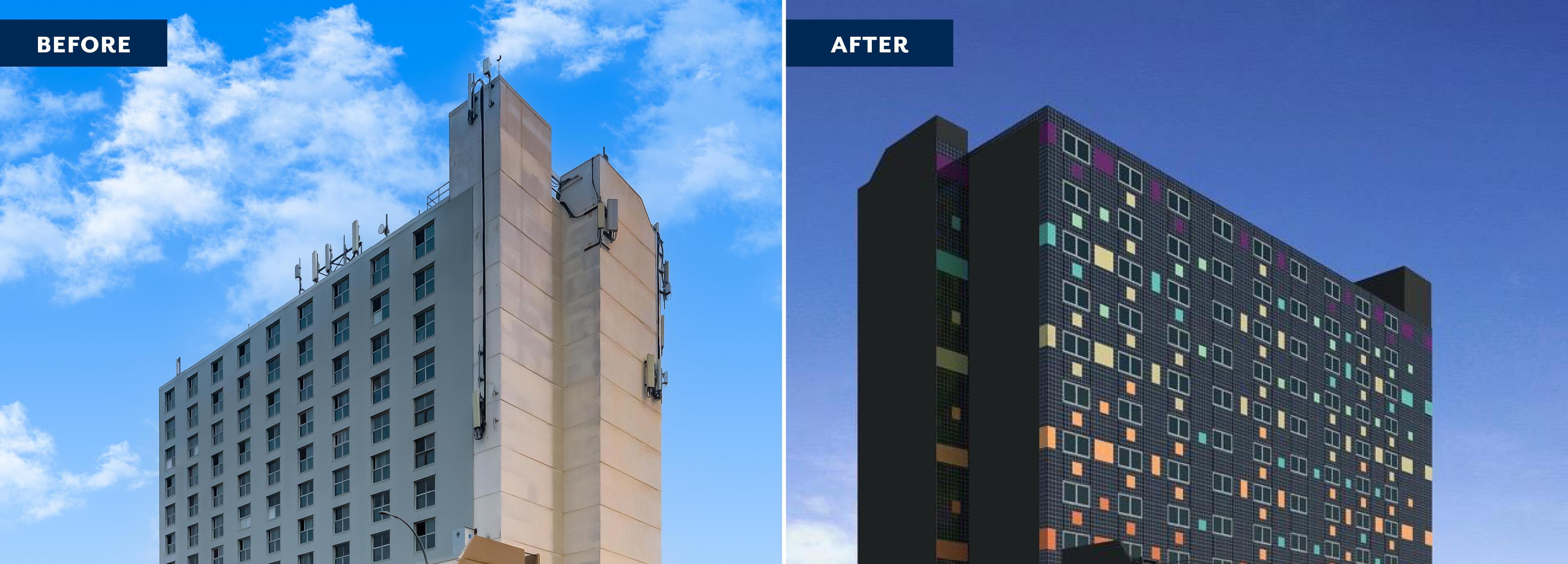

CALGARY, AB, April 29, 2024 /CNW/ - Avenue Living Asset Management, Ltd. (Avenue Living) is proud to announce an innovative funding partnership with BMO to revitalize a mixed-use multi-family residential and commercial building at 10609 101st Street NW in Edmonton, Alberta. The nearly $28 million project was made possible through BMO's short-term retrofit financing program and includes energy retrofits and sustainability upgrades that are expected to reduce the building's greenhouse gas emissions by up to 64 per cent. Additionally, with a current purpose-built rental vacancy rate of 2.4 per cent in the city, the project's 179 new units will significantly contribute to meeting the demand for housing in Edmonton's downtown core.

"As part of our Purpose, to Boldly Grow the Good in business and life, BMO is committed to being our clients' lead partner in the transition to a net-zero world," said Jeffrey Shell, Head of Alternatives, Commercial ESG and Innovation, BMO Global Asset Management. "Greenhouse gas emissions from buildings make up a large proportion of Canada's total emissions profile, requiring extensive energy retrofits to get to net zero. The BMO Retrofit Program is a testament to the way we collaborate across the bank, and partner with organizations and clients, to create new and effective sustainable solutions."

"We're excited to work with BMO on this project and retrofit our landmark 49-year-old building for the Edmonton community," said Jason Jogia, Chief Investment Officer, Avenue Living. "The BMO retrofit program supports our responsible investment goal to offer workforce housing residents with a high quality, affordable, and comfortable living experience for years to come."

"The renovation of this building is expected to inspire more projects like it in the downtown area, which will bring in more investment and create a fresh, lively atmosphere in the neighbourhood," notes Daniel Veniot, Avenue Living's Associate Vice President of Debt Capital Markets. "By investing in this asset, we are introducing new units in Edmonton to support a targeted demographic of essential workers, young professionals, and students, while ensuring that we're doing it in an environmentally friendly way."

"This retrofit sets a new standard for ambitious and forward-thinking development in the real estate sector," said Mike Beg, Head, Real Estate Finance, BMO Commercial Bank, Canada. "It's imperative to have collaborative partnerships with key players in the multi-family space so that we can advance sustainable finance initiatives to positively impact the community."

BMO and Sustainability

Carbon neutral in its own operations since 2010, BMO announced in March 2021 its Climate Ambition to be its clients' lead partner in the transition to a net-zero world. Since 2019, BMO has mobilized $330 billion in capital to clients pursuing sustainable outcomes, surpassing its commitment of $300 billion by 2025. This support included sustainable bond underwriting, loans to clients and projects pursuing sustainable outcomes, sustainable equity and debt financing, sustainable finance advisory services, and sustainable investments. In 2021, BMO launched the BMO Climate Institute and established a dedicated Energy Transition Group, to support clients' pursuit of opportunities driven by the increasing momentum of the global economy's shift in production and consumption of energy.

For information on BMO's Sustainable Real Estate initiatives, click here.

For information on BMO's Purpose and commitments to a sustainable future, visit its Sustainability Report, Purpose, Climate and Zero Barriers to Inclusion 2025 pages.

About BMO Financial Group

BMO Financial Group is the eighth largest bank in North America by assets, with total assets of $1.3 trillion as of January 31, 2024. Serving customers for 200 years and counting, BMO is a diverse team of highly engaged employees providing a broad range of personal and commercial banking, wealth management, global markets and investment banking products and services to 13 million customers across Canada, the United States, and in select markets globally. Driven by a single purpose, to Boldly Grow the Good in business and life, BMO is committed to driving positive change in the world, and making progress for a thriving economy, sustainable future, and inclusive society.

About Avenue Living Asset Management

Avenue Living offers an efficient way for investors to add real estate investments to their portfolios. Founded in 2006, the organization has grown to $6 billion in assets under management across Canada and the United States. The organization's real estate investment funds focus on assets that touch the everyday lives of North Americans — workforce housing, self-storage, and farmland. Avenue Living has strategically built a proprietary platform that supports a customer-centric management model, driving value for its customers, investors, and employees.

For information on Avenue Living's Sustainable Real Estate initiatives, visit its Responsibility page.

Avenue Living Media Contact: Tammy Cho, Calgary, tcho@avenueliving.ca; BMO Media Contact: Kelly Hechler, Toronto, kelly.hechler@bmo.com, (416) 867-3996

Read the feature in the Edmonton Journal.