Current global trade uncertainties have many Canadians reflecting on what it means to be Canadian and, for those involved in financial markets, the unique features of Canada’s economic foundation. One area where these distinctions are particularly evident is the performance of Canadian commercial mortgages, which have historically exhibited extremely low default rates and strong credit performance.

Canada’s commercial mortgage market: A model of stability

If you’re reading this, you’ve likely seen The Big Short and have occasionally spotted worrisome headlines about high-profile borrowers defaulting on large commercial mortgages and handing the properties back to their lenders. In the 1990s this came to be known as “jingle mail,” a tongue-in-cheek term for borrowers mailing the keys to a mortgaged property back to their lender.

However, The Big Short was about unbridled U.S. subprime residential mortgage lending—a market that has little in common with its far more disciplined commercial mortgage cousin. And mortgage defaults are in fact fairly uncommon in Canada.

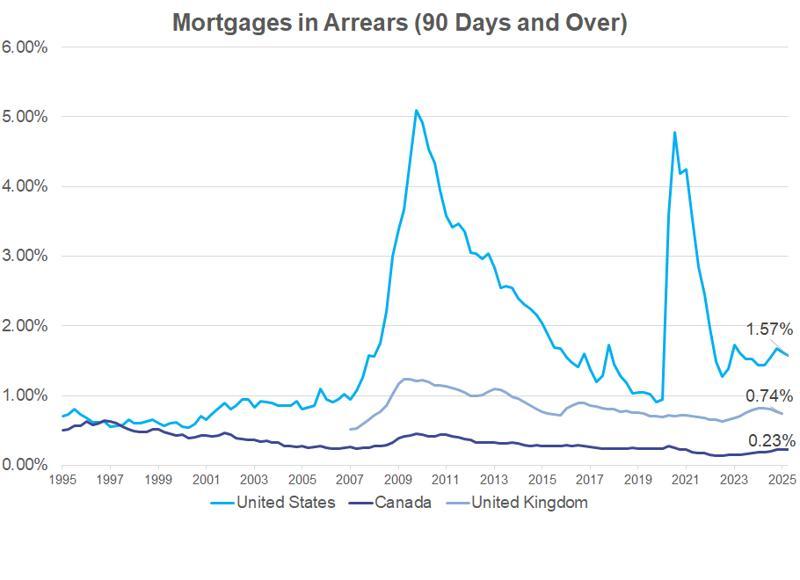

On the residential side of the mortgage market, Canada has consistently reported a low arrears (delinquency) rate compared to the U.S. and the U.K. According to data from the Canadian Bankers Association, through August 2025, the national arrears rate was 0.24%, compared to 0.74% in the U.K. and 1.57% in the U.S.

Chart: Number of residential mortgages in arrears (as of August 2025)

Residential mortgages in Canada have also demonstrated relative stability through periods of stress. While the U.S. arrears rate hovered around 5% during the 2007–2009 global financial crisis and the COVID-19 pandemic, Canada’s rate remained well below 1%.

Like its residential counterpart, Canada’s commercial mortgage market also sees consistently low default rates, reflecting its structural resilience and conservative lending practices. Proving this claim is challenging due to the private nature of Canada’s commercial mortgage market and limited public data. However, available information from Canadian commercial mortgage-backed securities (CMBS) provides some insight into the Canadian commercial mortgage market’s stability.

In the U.S., CMBS loan structures are largely shaped by investor risk appetites, which make them a poor reflection of traditional bank lending. In Canada, most CMBS loans are originated by major banks and typically remain on their balance sheets before any potential securitization. Because of this they are structured to materially align with the originating banks’ risk appetites for balance sheet loans, making Canadian CMBS a more reliable indicator of how those institutions’ broader commercial mortgage portfolios are performing.

According to credit rating agency KBRA, the loss rate on Canadian CMBS loans is very low, with a total cumulative loss of 0.2% (20 basis points) between 1998 and 2022, compared to 5.5% for CMBS loans globally. And as CMBS loans are typically a riskier subset of the market, often with stretched credit metrics on loan elements such as amortization period, loan-to-value and recourse, the performance of commercial mortgages that Canadian banks keep on their books is almost certainly even stronger than this.

Canadian CMBS delinquency is also very low, 0.9%, according to Morningstar DRBS’ latest monthly report—a figure that further underscores the strength of Canada’s commercial mortgage sector. This data reflects only a small portion of Canada’s commercial mortgage market. Due to their illiquidity and infrequent issuance in Canada, CMBS represents only about 1% of current outstanding commercial mortgage debt in Canada as opposed to a somewhat more significant 10% to 15% in the U.S. However, large Canadian banks indicate that it reasonably reflects the performance of their commercial mortgage portfolios.

Why Canada’s market is so stable

Several key factors contribute to the low delinquency rates, low credit loss rates and stability of Canada’s commercial mortgage market.

Recourse lending

Recourse is a defining feature of Canadian-style commercial mortgage lending. It’s arguably the most influential structural element in shaping borrower behavior and supporting market strength. Most Canadian loans require recourse, meaning lenders have access to security beyond the property being financed. Often, it’s a personal or corporate guarantee, or security over additional real estate assets of the borrower. This recourse provides lenders with an additional source of loan repayment, creates incentive for borrowers to avoid default and, when loans show signs of stress, encourages borrowers to engage early with their lender to look for ways to restructure problem loans while there’s still time to avoid default.

Legal framework

Canada’s legal system provides lenders with powerful and efficient tools to manage distressed loans. In Ontario, for example, a lender can initiate a power of sale process and sell a mortgaged commercial property in as little as 50 days after mortgage default, often avoiding the lengthy and expensive foreclosure proceedings common in many other markets. This comparatively lender-friendly framework provides an additional incentive for borrowers to avoid default.

Amortization

Commercial mortgages can be either amortizing, which require blended monthly payments of both principal and interest with any outstanding principal repaid at the end of the loan term, or interest-only, which only pay monthly interest through the loan term with all principal repaid as a balloon payment at the end of the loan term.

Interest-only loans are often attractive to borrowers as they provide additional cash flow to enhance their yield on the property investment or perform property improvements. However, they can lead to elevated repayment risk to the lender at the end of the loan term in events such as a decline in the property value, higher interest rates, a shortage of debt capital (as we saw with loans that matured during the financial crisis and COVID-19), or should the asset class fall out of favour, as is currently happening with maturing loans on office buildings.

The vast majority of Canadian commercial mortgages are amortizing, with monthly payment of both principal and interest. This causes Canadian mortgages to pay down over time, which mitigates default risk by reducing the lender’s exposure through the loan term in case something goes wrong, such as an unexpected decline in property income or value. Amortization also provides a gradually increasing equity cushion to alleviate renewal risk when the loan matures.

This prevalence of amortization in Canadian commercial mortgages lends additional stability to its mortgage market.

Institutional lenders

Canada’s commercial lending landscape is dominated by a small number of large, sophisticated and highly disciplined institutions—banks, pension funds and insurance companies. With fewer market participants compared with countries with less centralized banking systems, Canadian lenders—and specialized commercial real estate (CRE) lenders in particular—generally all know each other, have often worked together in the past and work from the same conservative underwriting rulebook. With less competition there is also less pressure to force Canadian lenders outside their comfort zone or “move the market” to win deals. And they’re all closely monitored by regulators such as OSFI, whose auditors are themselves often former bankers, so they know what questions to ask and where to look for process gaps.

Fewer lenders in Canada also provides an additional incentive for Canadian borrows to maintain good relationships with their lenders, honour their debts and “play nice.”

Institutional ownership

The ownership structure of Canada’s CRE inventory lends additional stability to Canada’s commercial mortgage market. Much of this inventory is owned by deep-pocketed financial institutions. These institutions typically have long-term investment horizons and both the capital and patience to weather cycles, gradually improve rent rolls, and redevelop or convert properties over time as markets evolve rather than sell assets at a loss when markets turn against them.

The positive stabilizing impact of institutional ownership is particularly evident in Canada’s office and retail sectors, which have shown less stress than those in countries with more fragmented ownership. Canada’s largest pension funds collectively own or manage over $1 trillion of commercial real estate assets, including the majority of Canada’s core office buildings and regional malls, which has recently lent support to these sectors as they recovered from the adverse impacts of the COVID-19 pandemic.

This patient and stable ownership structure helps anchor Canada’s CRE market and contributes to its resilience, particularly during downturns.

Relationship orientation

Arguably of greatest impact is Canadian lenders’ relationship orientation. Unlike transactional lenders focused primarily on loan volume, most Canadian lenders—and BMO in particular—tend to prioritize relationship lending, preferring to do more business with fewer customers who they know well and are comfortable with.

The implementation of Basel III banking regulations has compelled Canadian banks to adopt an even more disciplined approach to capital allocation, further reinforcing their emphasis on relationship-based lending. A similar relationship orientation is now beginning to emerge among U.S. banks as Basel III takes hold south of the border. This relationship strategy gives Canadian lenders deeper insight into the financial position of their customers and fosters a more open, less adversarial and, ultimately, more successful workout process when loans face challenges, further contributing to the market’s stability.

A foundation for future challenges

Canada’s commercial mortgage market stands out as a model of resilience and discipline in an increasingly volatile world. With exceptionally low delinquency and loss rates, the sector benefits from a uniquely Canadian combination of structural safeguards: recourse lending, amortization, a lender-friendly legal framework and a concentrated network of institutional lenders. These features not only mitigate risk but also foster collaborative long-term lending relationships and responsible borrower behavior.

While global markets grapple with rising defaults and shifting asset class dynamics, Canada’s commercial real estate market remains anchored by lenders’ and borrowers’ shared commitment to stability and prudence. As the market evolves, this foundation positions Canada to navigate future challenges with confidence and maintain its reputation as one of the most secure and well-managed commercial mortgage environments in the world.